Digital Banking Market Opportunities | Identifying Growth Potential

Digital Banking Market Opportunities | Identifying Growth Potential

|

Digital Banking Market Scope and Overview The Digital Banking Market is undergoing rapid transformation as financial institutions embrace digital technologies to meet evolving customer expectations and drive innovation in banking services. This market report provides a comprehensive analysis of the global digital banking market, offering insights into market trends, regional dynamics, competitive landscape, key objectives of the report, factors driving growth, and the market's strengths. Digital banking solutions have revolutionized the way customers interact with their banks, offering convenient access to banking services anytime, anywhere, through digital channels. We explore the key findings of the Digital Banking Market Report, shedding light on the transformative potential of digital banking in reshaping the banking industry.

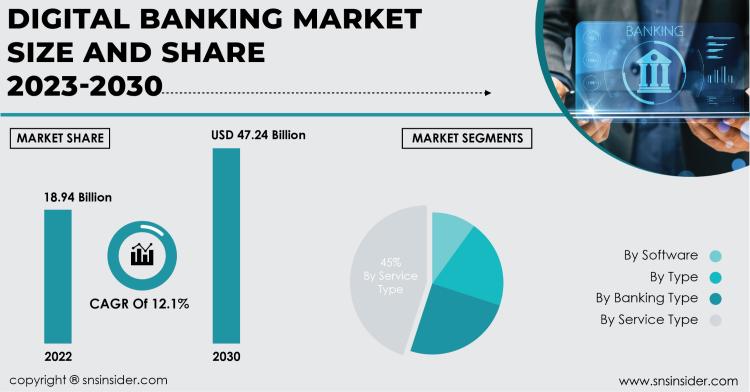

Market Segmentation and Sub-Segmentation Included Are: By Type:

By Software:

By Banking Type:

By Service Type:

Get a Sample Report of Digital Banking Market @ https://www.snsinsider.com/sample-request/1256 Regional Outlook The Digital Banking Market Report offers insights into the regional dynamics of the market, highlighting trends, opportunities, and challenges across different geographic regions. From North America to Europe, Asia Pacific, Latin America, and the Middle East, stakeholders can gain valuable insights into regional variations in digital banking adoption rates, regulatory environments, and market maturity. This regional perspective enables stakeholders to tailor their digital banking strategies to local market conditions and address regional banking challenges. Competitive Analysis The competitive landscape of the digital banking market is characterized by a diverse mix of players, including traditional banks, neobanks, fintech startups, and technology companies offering digital banking platforms and solutions. The market is marked by intense competition as providers vie for market share and seek to differentiate themselves through innovative features, user experience, and customer service. Some of the Major Key Players Studied in this Report are:

Key Objectives of the Report The Digital Banking Market Report aims to provide stakeholders with comprehensive insights into the market's current state and future potential. Key objectives of the report include:

Factors Contributing to the Growth of the Market Several factors are driving the growth of the digital banking market, including:

Conclusion In conclusion, the Digital Banking Market Report offers stakeholders valuable insights into the transformative potential of digital banking in reshaping the banking industry and driving customer-centric innovation. By understanding regional dynamics, competitive landscape, and factors driving market growth, stakeholders can make informed decisions and capitalize on opportunities to leverage digital banking solutions to enhance customer engagement, streamline operations, and drive business success in an increasingly digital world. Table of Contents

Bethany Stewart

Information & Communication Technology Research Associate |

| Free forum by Nabble | Edit this page |