Green Hydrogen Market in the UAE: The Next Big Opportunity for GCC Investors & Businesses

Green Hydrogen Market in the UAE: The Next Big Opportunity for GCC Investors & Businesses

|

The global energy landscape is shifting and the UAE is leading the transition in the Middle East. As countries race toward net-zero commitments, green hydrogen has emerged as one of the most promising clean-energy fuels of the future. For the GCC region long known for traditional hydrocarbons this shift is not just a trend but a strategic economic opportunity.

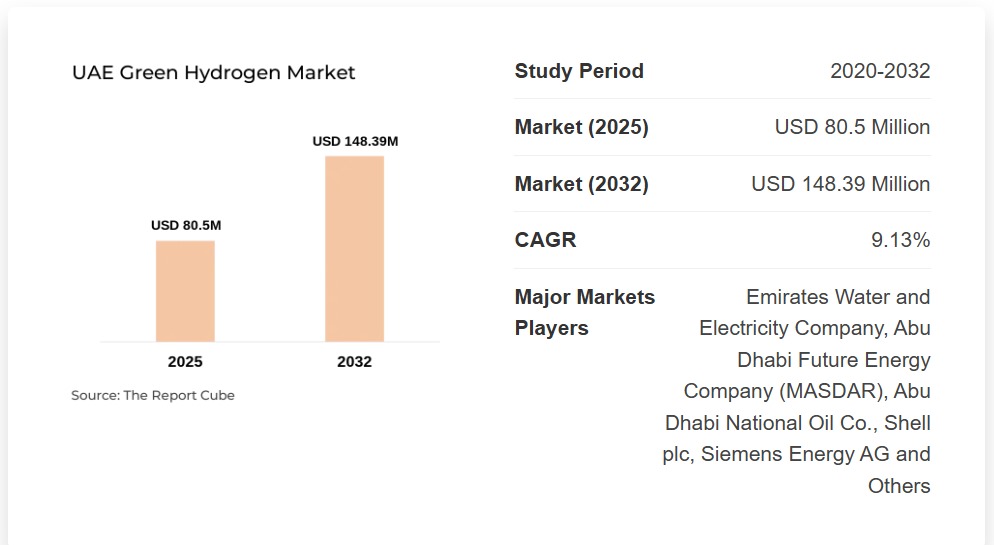

Today, the UAE Green Hydrogen Marketis forecasted to grow at a CAGR of nearly 9.13% from 2025 to 2032, driven by massive renewable energy investments, supportive policies, and ambitious national goals. For investors, industrial players, and clean-energy companies across the GCC, this sector offers high-growth potential and early-mover advantages. Why the UAE Is Becoming the Green Hydrogen Leader of the GCC 1. Abundant Solar Energy and Low Renewable Costs The UAE has some of the world’s highest solar irradiation levels. Mega-projects like the Mohammed bin Rashid Al Maktoum Solar Park ensure extremely competitive renewable electricity essential for low-cost green hydrogen production. 2. Strong Government Roadmap & Policy Push The UAE National Hydrogen Strategy 2050 aims to position the nation as a global hydrogen hub. Targets include: • 1.4 million tonnes of green hydrogen by 2031 • 15 million tonnes by 2050 • Hydrogen “Oases” and export corridors built across UAE ports and industrial zones This makes the UAE one of the most aggressive hydrogen adopters globally. 3. Flagship Projects Already Operational The UAE is not just planning—it is building. • DEWA’s pilot green hydrogen plant using 100% renewable power • Masdar’s hydrogen initiatives focused on green ammonia, mobility, and industrial supply • TA’ZIZ Industrial Ecosystem, integrating hydrogen with downstream petrochemicals • Partnerships with Siemens, Engie, ADNOC, Fertiglobe, and other global players These early deployments help reduce risk and attract global investors. 4. Perfectly Positioned for Hydrogen Exports With world-class ports, logistics infrastructure, and proximity to Asia & Europe, the UAE is on track to become the hydrogen export hub of the GCC. Export opportunities include: • Green hydrogen • Green ammonia • Hydrogen-based fuels Download an Exclusive Sample of the UAE Green Hydrogen Market Report in PDF Format Today! https://www.thereportcubes.com/request-sample/green-hydrogen-market-uae UAE Green Hydrogen Market Size & Forecast (2025–2032)According to recent market analysis:• Market value in 2025: ~USD 80.5 million • Market value by 2032: ~USD 148.39 million • CAGR: ~9.13% (2025–2032) Other reports indicate even faster growth depending on technology adoption and export demand. This growing market aligns with the GCC’s broader shift toward clean energy and diversification. Key Demand Drivers in the UAE 1. Industrial Decarbonization Industries such as: • Steel • Aluminium • Chemicals • Fertilizers • Refining Are seeking green hydrogen to reduce emissions and meet global ESG compliance. 2. Hydrogen for Mobility Fuel-cell vehicles (buses, trucks, fleet vehicles) are expected to grow rapidly as the UAE explores hydrogen transport corridors. 3. Power Generation & Storage Green hydrogen enables: • Seasonal energy storage • Backup power • Grid stability • Integration of renewables 4. Green Ammonia for Exports With global demand rising for clean ammonia, UAE can supply Europe, Japan, Korea, and beyond. Challenges & Barriers for GCC Stakeholders While the opportunity is large, some challenges remain: • High capital cost for electrolyzers and storage systems • Hydrogen transport & logistics infrastructure is still limited • Standardization & regulation still evolving in GCC • Competitiveness against other global hydrogen exporters • Technology maturity, depending on electrolyzer type (PEM, Alkaline, SOEC) However, with falling renewable costs and strong policy direction, these barriers are expected to ease by 2030. With strong competition among global and regional players, the market is highly fragmented. Discover the major trends shaping the future of the Top 10 UAE Green Hydrogen Market companies: https://www.thereportcubes.com/report-store/green-hydrogen-market-uae GCC-Wide Benefits: Why UAE’s Hydrogen Growth Matters to the Region The UAE’s momentum fuels a regional shift. 1. Economic Diversification Hydrogen provides a long-term alternative revenue stream for oil-dependent economies. 2. Job Creation Hydrogen production, storage, transport, and export infrastructure will open thousands of new skilled jobs in: • Engineering • R&D • Logistics • Project development 3. Export Growth The GCC can jointly position itself as the largest global supplier of clean fuels. 4. Attracting International Investment Partnerships with Europe, Japan, and Korea will boost the region’s global energy influence. Key UAE Players to Watch • Masdar – spearheading green hydrogen projects • ADNOC – integrating hydrogen into its industrial ecosystem • DEWA – operating the UAE’s first green hydrogen plant • Engie, Siemens Energy, Shell – global partners driving hydrogen technology and scale These companies are actively forming joint ventures and signing long-term offtake agreements. Future Outlook: What’s Next for UAE’s Green Hydrogen Market? Over the next decade, the UAE will accelerate: • Gigawatt-scale hydrogen plants • Hydrogen fuel export terminals • Green steel and green aluminium production • Hydrogen-powered buses and heavy mobility • Advanced storage & pipeline infrastructure • Multi-billion-dollar foreign investments By 2030, the UAE aims to be the Middle East’s most competitive producer of green hydrogen. Opportunities for Investors & Businesses in the GCC If you’re an investor, project developer, or industrial company in the GCC, you can participate through: 1. Equity Investments Invest in electrolyzer manufacturers, hydrogen producers, and technology companies. 2. Joint Ventures Partner with UAE entities such as Masdar, ADNOC, DEWA, TA’ZIZ. 3. Offtake Agreements Secure long-term hydrogen or green ammonia supply contracts. 4. Technology & R&D Partnerships Collaborate on electrolyzer innovation, storage solutions, and hydrogen mobility. 5. Clean-Energy Consulting & Advisory Organizations can offer engineering, feasibility studies, and project execution services. Conclusion The green hydrogen market in the UAE is not just a futuristic idea—it is a rapidly growing, highly funded, and government-backed industry that will reshape the GCC’s energy landscape. With strong policy frameworks, world-leading solar capacity, and early-scale projects already running, the UAE is positioning itself as the clean-energy capital of the Middle East. For investors, policymakers, and clean-energy companies across the GCC, now is the best time to engage, partner, and invest in the UAE’s hydrogen expansion. Have questions or looking for something more specific? Customization is available—we’re here to tailor our solutions to your needs. About The Report CubeThe Report Cubes provides in-depth market research, industry insights, competitive analysis, and strategic forecasts across emerging global industries. Their healthcare and technology reports are used by global investors, policymakers, and enterprises to support strategic planning. |

«

Return to OFBiz

|

1 view|%1 views

| Free forum by Nabble | Edit this page |