Online Banking Market Size, Share, and Growth Analysis | Business Insights

Online Banking Market Size, Share, and Growth Analysis | Business Insights

|

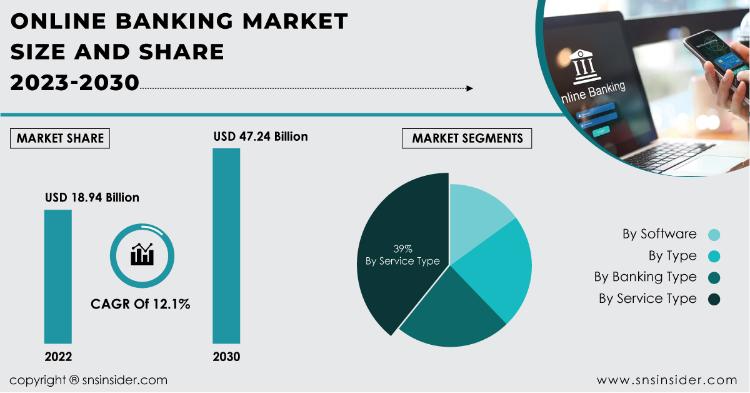

Online Banking Market Report Scope and Overview Amidst a landscape fraught with uncertainties, the unveiling of the Online Banking Market Report marks a significant milestone in the quest for clarity and direction. This comprehensive report offers invaluable insights into the dynamics of the Online Banking Market, providing stakeholders with a strategic roadmap to navigate through turbulent times and capitalize on emerging opportunities. As the world grapples with geopolitical tensions, economic downturns, and technological disruptions, the Online Banking Market Report emerges as a beacon of insight, empowering businesses to chart a course towards sustainable growth and resilience. In the digital era, where convenience and accessibility reign supreme, the Online Banking Market emerges as a cornerstone of modern finance, transforming the way individuals and businesses manage their finances. As consumers increasingly prefer digital channels for banking transactions and financial services, traditional brick-and-mortar branches are being supplemented, and in some cases supplanted, by online banking platforms. The Online Banking Market addresses these changing preferences by offering secure, user-friendly digital banking solutions that enable customers to perform a wide range of financial activities remotely, such as account management, fund transfers, bill payments, and loan applications. With the advent of mobile banking apps and the integration of advanced features like biometric authentication and AI-powered financial insights, online banking has become synonymous with convenience, efficiency, and personalized banking experiences, driving the growth of the Online Banking Market globally. Get a Sample Report of Online Banking Market @ https://www.snsinsider.com/sample-request/1233

Competitive Landscape The Online Banking Market Report offers a panoramic view of the competitive landscape, dissecting the strategies, strengths, and weaknesses of key players within the Online Banking Market. Through meticulous analysis and market intelligence, the report unveils the intricacies of market positioning, enabling stakeholders to identify untapped opportunities and forge strategic partnerships. By delving into factors such as innovation, pricing strategies, and customer engagement, the report equips businesses with the knowledge needed to stay ahead in an increasingly competitive environment. Some of the Major Key Players Studied in this Report are:

Regional Analysis Spanning across geographies, the Online Banking Market Report provides a comprehensive regional analysis, shedding light on the diverse market dynamics and growth prospects across different regions. From the established markets of North America to the emerging economies of Asia-Pacific, each region presents unique opportunities and challenges within the Online Banking Market. By examining regulatory frameworks, cultural nuances, and economic indicators, the report enables stakeholders to tailor their strategies according to regional preferences and market demands, ensuring maximum relevance and impact. Market Segmentation and Sub-Segmentation Included Are: By Type:

By Software:

By Banking Type:

By Service Type:

Impact of the Russia-Ukraine War Amidst escalating geopolitical tensions, the Russia-Ukraine war casts a shadow of uncertainty over global markets, including the Online Banking Market. The Online Banking Market Report meticulously analyzes the implications of this conflict, ranging from supply chain disruptions to shifting consumer sentiments and market volatility. By forecasting the ripple effects of the war on industry dynamics and trade patterns, the report empowers businesses to mitigate risks and capitalize on emerging opportunities amidst geopolitical uncertainties, fostering resilience and adaptability in an ever-changing landscape. Get a Discount @ https://www.snsinsider.com/discount/1233 Impact of the Recession As the global economy grapples with the repercussions of a recession, the Online Banking Market faces a myriad of challenges and uncertainties. The Online Banking Market Report explores the impact of the recession on consumer spending patterns, market demand, and investment sentiments within the Online Banking Market. By identifying emerging trends and market dynamics, the report equips stakeholders with actionable insights to navigate through economic downturns, optimize resource allocation, and position themselves for long-term growth and sustainability in a post-recessionary environment. Conclusion In a world characterized by volatility and disruption, the Online Banking Market Report emerges as a beacon of clarity and foresight, guiding stakeholders through the complexities of the Online Banking Market with confidence and resilience. From unraveling competitive dynamics to deciphering the impact of global geopolitical and economic upheavals, the report equips businesses with the knowledge and strategies needed to thrive in an ever-evolving landscape. As markets continue to navigate through uncharted waters, the Online Banking Market Report stands as a testament to innovation, strategic agility, and forward-thinking, empowering stakeholders to seize opportunities and overcome challenges in pursuit of sustained growth and success. Table of Contents- Major Key Points

Bethany Stewart

Information & Communication Technology Research Associate |

| Free forum by Nabble | Edit this page |